How to Handle Low Offers: Strategies for For Sale by Owner Sellers

Negotiating low offers can pose a distinct challenge to FSBO sellers. Unlike sellers who rely on real estate agents, FSBO sellers must navigate these negotiations on their own. However, with the right strategies, you can confidently handle low offers and still achieve a favorable outcome. This guide will walk you through the reasons buyers make low offers, how to assess those offers, and practical strategies to counter them effectively. Understanding Why Buyers Make Low Offers Low offers can be frustrating, but they often have a rationale behind them. Understanding the “why” can help you respond strategically. Market Dynamics and Buyer Psychology Buyers know that FSBO sellers typically lack professional representation, which they may see as an opportunity to negotiate harder. Additionally, in a buyer’s market—where supply exceeds demand—low offers become more common as buyers feel they have leverage. Common Buyer Tactics in FSBO Transactions Some buyers intentionally lowball to test your limits, hoping you’ll counter with a lower price than your original asking price. Others might base their offer on perceived flaws in your home or market conditions, whether accurate or not. Assessing the Offer Objectively Before reacting emotionally to a low offer, take a step back and evaluate its merits. How to Evaluate if a Low Offer Is Reasonable Ask yourself: Does the offer align with recent comparable sales (comps) in your neighborhood? Are there valid reasons behind the buyer’s lower valuation, such as necessary repairs or outdated features? Comparing the Offer to Your Target Price Your initial price should already account for market conditions, comps, and the home’s unique features. If a buyer’s offer falls significantly short of this, determine whether there’s room for compromise or if it’s simply too low to consider. Strategies for Responding to Low Offers A low offer isn’t necessarily a dealbreaker. It’s often just a starting point for negotiations. Counteroffer Techniques for FSBO Sellers Rather than outright rejecting a low offer, respond with a counteroffer that reflects your minimum acceptable price. Use the counteroffer to anchor the negotiation in your favor. Leveraging Multiple Offers If you have more than one interested buyer, let them know they’re competing. This can drive offers closer to (or even above) your asking price. When (and How) to Say No Sometimes, the best move is to walk away. Knowing When to Walk Away If a buyer is unwilling to meet your minimum price or insists on unreasonable demands, it may not be worth pursuing the deal. Trust your pricing strategy and keep looking for serious buyers. Setting Boundaries Without Alienating Buyers When rejecting an offer, maintain a professional tone. Thank the buyer for their interest, explain why the offer isn’t acceptable, and invite them to submit another proposal if they’re willing to reconsider. Negotiation Tips for FSBO Sellers Successful negotiation relies on preparation and effective communication. Communicating Effectively Without an Agent Clear, professional communication is key. Respond to offers promptly, use data to back up your pricing, and be open to reasonable discussions. Using Data and Facts to Justify Your Price Share recent comps, appraisal reports, or details about recent upgrades to demonstrate the value of your home. Facts are harder to dispute and can help persuade buyers to increase their offer. Concessions That Work in Your Favor Sometimes, making small concessions can help close the deal without sacrificing too much. Offering Incentives Instead of Price Cuts Consider offering to cover part of the buyer’s closing costs, include appliances, or expedite the closing timeline. These perks may be more appealing than a lower price. Non-Monetary Negotiation Points Flexibility on the move-in date or including a home warranty can sweeten the deal without reducing your net proceeds. Preventing Low Offers Before They Happen The best way to handle low offers is to minimize the likelihood of receiving them in the first place. How Pricing Your Home Correctly Reduces Lowball Offers Price your home competitively from the start by researching comps and understanding current market conditions. Overpriced homes attract fewer serious buyers, which can lead to more lowball offers. Crafting a Compelling FSBO Listing A well-crafted listing with high-quality photos, a detailed description, and a strong online presence attracts motivated buyers who are less likely to undervalue your property. FAQs: Common Questions from FSBO Sellers Why do FSBO sellers often receive low offers? Buyers may assume FSBO sellers lack negotiation skills or are eager to sell quickly, making them more likely to test the waters with a low offer. How can I counter a low offer without losing the buyer? Respond with a counteroffer that demonstrates your home’s value and consider offering small concessions to bridge the gap. What should I do if I keep getting low offers? Reevaluate your pricing strategy, ensure your listing highlights the home’s value, and consider gathering feedback from prospective buyers. Conclusion Negotiating low offers as a FSBO seller requires preparation, patience, and strategy. By understanding buyer behavior, evaluating offers objectively, and mastering negotiation techniques, you can turn even lowball offers into opportunities to sell your home on favorable terms. For more tips and tools to help you navigate your FSBO journey, explore the resources available at HomeRise.

Home Inspection 101: What Sellers Should Expect When Selling Without an Agent

Selling your home without a realtor—commonly referred to as “For Sale By Owner” (FSBO)—can be an empowering choice, but it also requires careful preparation. One of the most critical steps in this process is the home inspection. Whether you’re a seasoned FSBO seller or navigating this for the first time, understanding the home inspection process can help you avoid surprises and maintain control of your sale. This guide will walk you through everything you need to know to prepare for and handle a home inspection without a realtor. Understanding the Home Inspection Process What Is a Home Inspection? A home inspection is a thorough evaluation of your property conducted by a licensed inspector. This process identifies the condition of the home, highlighting any issues with structural integrity, major systems (like HVAC or plumbing), and safety concerns. Why Is a Home Inspection Important for FSBO Sellers? For buyers, the home inspection provides reassurance that the property is a sound investment. For FSBO sellers, this step is crucial to avoid surprises that could delay or derail your sale. A positive inspection report builds buyer confidence, while being upfront about any issues can help you negotiate effectively. Who Typically Hires and Pays for the Home Inspection? In most cases, the buyer arranges and pays for the home inspection. However, as a FSBO seller, you might choose to conduct a pre-listing inspection to identify and address issues early, which can streamline the selling process. Preparing for the Inspection How Can FSBO Sellers Prepare Their Home for an Inspection? Preparation is key to a smooth inspection process. Here are some steps to get your home ready: Declutter and Clean: Ensure all areas of the home are accessible, including basements, attics, and crawl spaces. Check Functionality: Test lights, faucets, appliances, and smoke detectors to ensure they are working properly. Address Minor Repairs: Fix leaky faucets, loose doorknobs, and squeaky hinges to avoid red flags. What Common Issues Do Inspectors Look For? Inspectors focus on a range of areas, including: Foundation cracks or water damage. Roof leaks or missing shingles. Electrical issues or outdated wiring. Plumbing problems, such as leaks or poor water pressure. HVAC system efficiency and age. Should You Repair Issues Before the Inspection? If you’re aware of significant problems, addressing them before the inspection can save you from lengthy negotiations. However, for minor issues, you may choose to wait and discuss solutions with the buyer post-inspection. Navigating the Inspection Results What Happens After the Inspection? Once the inspection is complete, the buyer receives a detailed report outlining the findings. Depending on the results, the buyer might: Proceed with the sale as-is. Request repairs or a price reduction. Back out of the sale (if allowed by the contract). How Should FSBO Sellers Handle Buyer Requests for Repairs or Credits? The key to handling post-inspection requests is flexibility. Some common options include: Agreeing to fix specific issues. Offering a credit at closing to cover repair costs. Negotiating a price reduction. Can FSBO Sellers Negotiate Inspection Findings Effectively Without an Agent? Yes! The inspection report is a tool for negotiation, not a mandate. Be prepared to explain your reasoning for accepting or declining certain requests. A professional attitude and willingness to compromise can keep the deal moving forward. Common Inspection Challenges and Solutions What If the Inspection Reveals Major Issues? Major issues, like a faulty foundation or outdated electrical system, can be daunting. Options include making repairs, offering credits, or adjusting the price. A pre-listing inspection can help you address these concerns upfront. How Can FSBO Sellers Avoid Surprises During the Inspection? Being proactive is key. Regular maintenance, thorough cleaning, and addressing known issues can help you minimize surprises. Consider hiring a professional for a pre-listing inspection to get ahead of any potential problems. What Are the Most Common Deal Breakers for Buyers After Inspections? Some of the biggest red flags for buyers include: Mold or water damage. Termite infestations. Structural issues. Outdated or unsafe electrical systems. Tips to Streamline the Inspection Process How Can FSBO Sellers Make Their Home Inspection-Ready? An inspection-ready home is one that is clean, accessible, and in good condition. Provide clear access to all areas, and prepare a file with warranties and receipts for repairs or upgrades. What Are Some Tips to Minimize Delays Caused by the Inspection? Respond to buyer requests promptly. Be upfront about known issues. Have a plan for repairs or credits ready to present during negotiations. Should FSBO Sellers Consider a Pre-Listing Inspection? A pre-listing inspection is an excellent way to identify issues before buyers do. While it involves an upfront cost, it can save time and reduce stress during the sale process. Selling your home without a realtor might feel overwhelming at times, but with a solid understanding of the home inspection process, you can navigate it successfully. Preparing your home, understanding what to expect, and responding proactively to inspection findings will set you up for a smoother, faster sale.

5 Common Mistakes For Sale By Owner Sellers Make (and How to Avoid Them)

Selling a home without an agent—commonly known as For Sale By Owner (FSBO)—can save you money on commissions, but it also comes with challenges. Many FSBO sellers make avoidable mistakes that cost time, money, and even potential buyers. By understanding these common pitfalls and how to avoid them, you can successfully navigate the FSBO process and sell your home on your terms. Below, we explore the five most common FSBO mistakes and offer practical tips to help you steer clear of them. 1. Pricing Mistakes Overpricing Due to Emotional Attachment Your home holds countless memories, which can make it easy to overvalue it. However, buyers are looking for fair market value, not sentimental worth. Overpricing your home can lead to fewer showings, longer market times, and ultimately lower offers. Underpricing Due to Lack of Market Knowledge On the flip side, underpricing your home can leave money on the table. Sellers unfamiliar with their local market might not realize the true value of their property, especially in hot markets where demand drives up prices. Solution: Use Comparative Market Analysis (CMA) or Online Tools Conducting a Comparative Market Analysis (CMA) can help you determine a realistic price based on recent sales of similar homes in your area. Additionally, consider online valuation tools as a starting point, but pair them with deeper research or professional advice for accuracy. 2. Incomplete or Poor Marketing Low-Quality Photos In today’s digital-first world, the quality of your listing photos can make or break buyer interest. Blurry, dimly lit, or poorly staged photos won’t attract serious buyers. Minimal Visibility Not listing on the Multiple Listing Service (MLS) or neglecting social media promotion limits your home’s exposure. Without sufficient visibility, your chances of connecting with qualified buyers drop significantly. Solution: Invest in Professional Photography and Flat-Fee MLS Services High-quality photography is worth the investment. Many photographers offer packages that include professional photos and virtual tours. Additionally, using a flat-fee MLS service ensures your property reaches the widest audience, as MLS feeds into platforms like Zillow and Realtor.com. 3. Failing to Prepare the Home Skipping Staging or Neglecting Repairs First impressions matter. Homes that are cluttered, outdated, or visibly in need of repair often fail to attract competitive offers. Buyers may assume that deeper, unseen issues lurk behind the surface. Not Decluttering or Depersonalizing Personal touches like family photos, unique decor, or bold paint colors can distract potential buyers. They may struggle to envision themselves living in the space. Solution: Staging and Minor Renovations Staging: Rearrange furniture to maximize space and create a welcoming atmosphere. Decluttering: Clear countertops, remove personal items, and simplify decor. Repairs: Fix small issues like leaky faucets, squeaky doors, and chipped paint to improve your home’s appeal. 4. Not Understanding Legal Requirements Omitting Required Disclosures Every state has specific disclosure requirements that sellers must follow. Failing to provide these can lead to legal complications or delays in the sale process. Errors in Contracts or Negotiations FSBO sellers often underestimate the complexities of real estate transactions, leading to mistakes in purchase agreements or negotiations. Solution: Work with a Real Estate Attorney or Title Company A real estate attorney or title company can guide you through the legal and contractual aspects of selling your home. This ensures compliance with disclosure laws and avoids costly errors. 5. Limited Availability for Showings Missing Potential Buyers by Being Unavailable If you can’t accommodate buyer schedules, you risk losing opportunities to make a sale. FSBO sellers often juggle showings with work, family, and other obligations, leading to missed connections. Lack of Flexibility Rigid showing times can frustrate buyers and cause them to move on to other properties. Solution: Streamline Your Showing Schedule Create a flexible but organized schedule for showings. Consider using a lockbox for added convenience, allowing buyers and their agents to view the home even if you’re not available. Key Takeaways for FSBO Sellers Selling your home without an agent requires careful planning and execution. By avoiding these five common mistakes—pricing errors, poor marketing, lack of preparation, legal missteps, and limited availability—you can enhance your chances of a successful sale. Remember, FSBO doesn’t mean going it entirely alone; enlisting professional help for specific tasks like photography, legal guidance, and MLS listing can make all the difference.

Is Zillow Zestimate Accurate? (The Truth About the 7.5% Gap)

Is the Zillow Zestimate Accurate? (The Truth Behind the Value) The Short Answer: For on-market homes (listed for sale), the Zillow Zestimate is fairly accurate, with a median error rate of 1.9%. However, for off-market homes, the Zillow Zestimate error rate jumps to 7.5%. This means that if your home isn’t currently listed for sale, your Zillow Zestimate could be off by tens of thousands of dollars. So what, exactly, is the Zillow Zestimate? The Zillow Zestimate is the company’s proprietary home valuation tool. It uses a complex algorithm (updated frequently) to generate a Zillow Zestimate for over 100 million homes in the U.S. It relies on a mix of public data (tax records) and user-submitted data. However, the Zillow Zestimate’s accuracy depends entirely on data availability. If Zillow doesn’t know you finished your basement or updated your kitchen, the Zillow Zestimate cannot price those upgrades. There are a few terms that are important to understand: Zillow Zestimate: An approximate amount a computer predicts your home would sell for, based on the sales of “similar” nearby properties. True market value: What a buyer is actually willing to pay for a home today. List price/asking price: The amount set by the homeowner and their agent. Because homes currently on the market have more verified data publicly available (like current photos and descriptions), their Zillow Zestimates tend to be much more accurate than off-market homes. How accurate is the Zillow Zestimate in 2025? The Zillow Zestimate is useful for a ballpark figure, but it is not an appraisal. According to Zillow’s own data, the accuracy varies wildly depending on whether the home is listed for sale or not: On-Market Homes: The nationwide median error rate for the Zillow Zestimate is 1.9%. Off-Market Homes: The nationwide median error rate is 7.5%. What does this error rate look like in real dollars? A 7.5% error rate might sound small, but when applied to real estate prices, the gap is massive. Take a home with a true market value of $600,000. If the Zillow Zestimate is off by 7.5%, the estimated value could range from $555,000 to $645,000. That is a $90,000 swing. If you rely on that number to refinance your mortgage or set your list price, you could be leaving money on the table—or pricing yourself out of the market entirely. The “Zillow Offers” Cautionary Tale The biggest proof that the Zillow Zestimate isn’t perfect came from Zillow itself. Until late 2021, Zillow ran a business called Zillow Offers, where they used their own Zillow Zestimate algorithm to make cash offers on homes. The result? Zillow lost hundreds of millions of dollars because their algorithm frequently overpaid for homes it couldn’t accurately value. Zillow ultimately shut down the iBuying branch of their business. If the company couldn’t trust the Zillow Zestimate enough to run a profitable business, you should be wary of trusting it blindly for your own net worth. Zillow Zestimate vs. Redfin Estimate Homeowners often ask: Is Redfin or the Zillow Zestimate more accurate? Generally, Redfin is considered slightly more accurate for off-market homes. Redfin claims a median error rate of roughly 6.45% for off-market homes (compared to the Zillow Zestimate’s 7.5%) and about 2.1% for on-market homes. Why the difference? Data Source: Redfin is a brokerage, meaning they have direct access to the MLS (Multiple Listing Service) in the markets they serve, which updates data in real-time. Zillow: While Zillow also has MLS feeds, the Zillow Zestimate algorithm historically relies heavily on user data and tax assessments, which can lag behind the market. Recommendation: Don’t just check one. Look at your Zillow Zestimate, Redfin Estimate, and Realtor.com. If all three give you a similar number, you have a decent baseline. If they vary wildly, your home likely has unique features that algorithms can’t see. What factors hurt Zillow Zestimate accuracy? Why is the Zillow Zestimate often wrong? It usually comes down to things the computer can’t “see.” 1. Interior Condition & Renovations “Zillow can’t see inside your home,” explains Baltimore-based listing agent June Piper-Brandon. If you renovated your kitchen in 2023, the Zillow Zestimate doesn’t know unless you pulled a permit or uploaded photos. Scenario: You and your neighbor have identical houses. You spent $50k on a new kitchen; they have the original 1990s cabinets. The Zillow Zestimate will likely value both homes at the exact same price. 2. Neighborhood Nuances Zillow treats neighborhoods as broad data sets. It often cannot distinguish between the “quiet street” and the “busy street” just one block over. The “Nice Block” Problem: If your home is on a desirable cul-de-sac but recent sales occurred on a busy main road nearby, the Zillow Zestimate algorithm may pull those lower comps, dragging your value down. 3. Rapid Market Changes In a rapidly shifting market (like the post-2020 boom), algorithms lag. They rely on past sales (comps). If the market jumps 5% in a single month, the Zillow Zestimate will trail behind until enough new sales close to prove the trend. Can you dispute or change your Zillow Zestimate? You cannot strictly “dispute” the value to force Zillow to change it, but you can influence your Zillow Zestimate by updating your home’s data. How to update your Zillow Zestimate: Claim your home: Create a user account on Zillow and verify you are the owner. Update facts: Correct the number of bedrooms, bathrooms, and square footage. Add improvements: Check boxes for remodels or new amenities (like A/C or a new roof). Note: Zillow uses public tax records as the “truth.” If your tax record says you have 3 bedrooms but you actually have 4 (and never permitted the addition), the Zillow Zestimate may not update even if you claim it, because the official record contradicts you. How to get a real home valuation If you are serious about selling, do not use the Zillow Zestimate to set your price. Get a CMA (Comparative Market Analysis): A local real estate agent will do this for free. They look

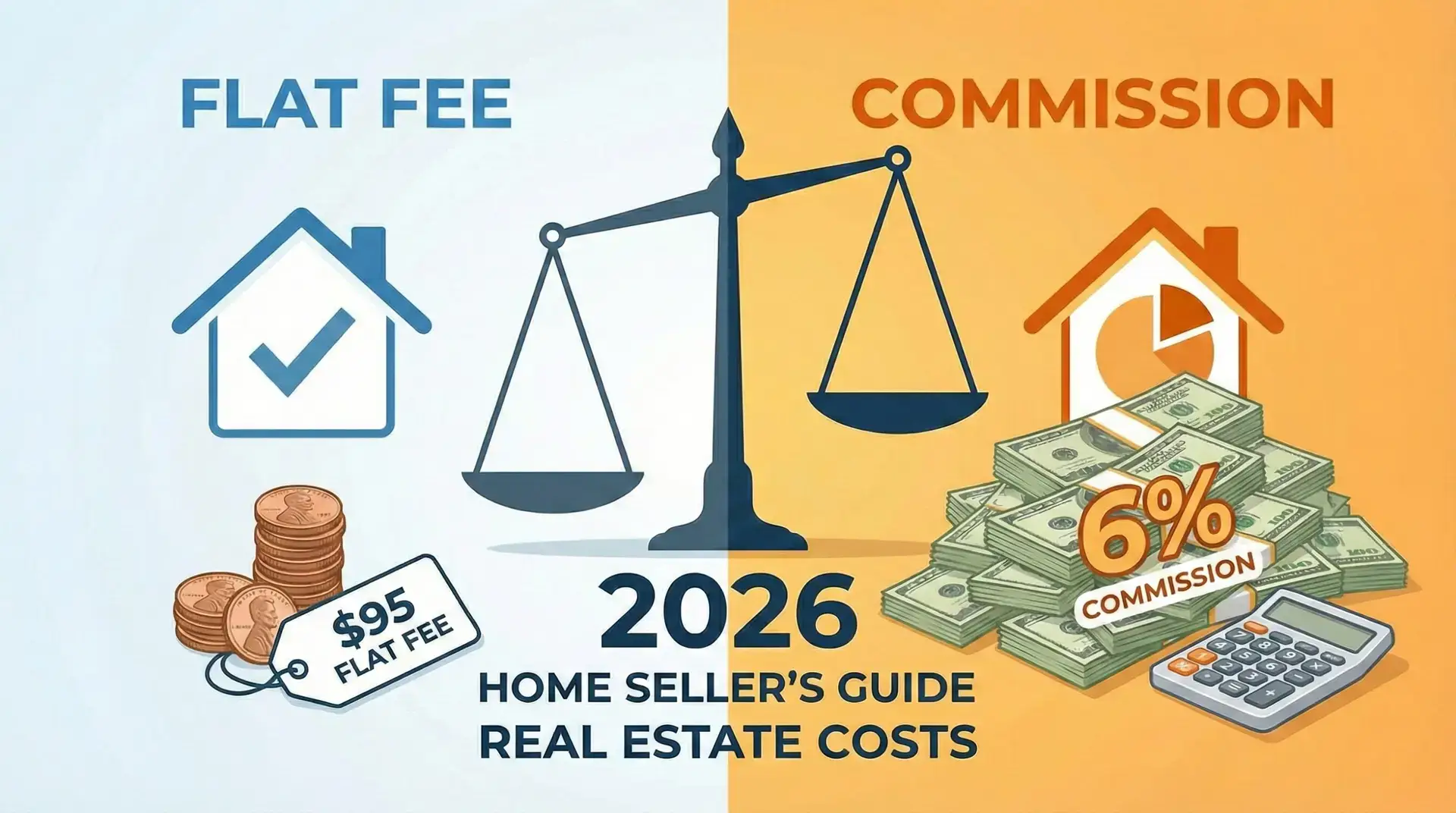

Flat Fee vs Commission: The 2026 Home Seller’s Guide to Real Estate Costs

Flat Fee vs Commission Real Estate In 2026, U.S. home sellers face a pivotal choice: stick with traditional commission-based real estate agents or leverage a flat fee model to save thousands. With the National Association of Realtors’ (NAR) settlement taking effect in August 2024, the average combined commission for buyer’s and seller’s agents now hovers around 5.44% nationwide. For a $400,000 home, that’s roughly $22,000 in fees. But alternatives like flat fee services-charging as little as $100 to $1,000 upfront-are gaining ground, offering the promise of savings from $7,000 to $30,000 or more per sale. These changes matter tremendously for homeowners, especially those considering For Sale By Owner (FSBO) or seeking more control over their sale. This guide delivers a clear, data-driven comparison of flat fee and commission models, answers core seller questions, and demonstrates how HomeRise empowers sellers with transparent pricing, regional data, and real-world expertise. Introduction: Selling Your Home in 2026 Selling a home in 2026 is fundamentally different than just a year ago. The NAR settlement, enacted in August 2024, transformed commission structures and negotiation norms, giving sellers more leverage to choose the model that best suits their needs. Today, the average combined commission rate for U.S. home sales stands at 5.44%, but sellers are no longer locked into this system. Flat-fee real estate services have emerged as a competitive alternative, promising significant cost savings and greater transparency. For many, the choice between a flat fee and a traditional commission model is the single most important financial decision in the home-selling process. Experienced sellers now weigh not just commission rates, but also control, exposure, and the level of professional support needed to maximize their proceeds. According to recent market data, sellers can negotiate lower rates, explore flat-fee alternatives, or opt for discount brokers, making it crucial to understand the financial and practical trade-offs involved. Quick Comparison Table: Flat Fee vs Commission Models Feature Flat Fee Listing Traditional Commission Cost to Seller One-time fixed rate (e.g., $99–$499). You keep the entire listing commission savings. Percentage of Sale Price (typically 2.5%–3% for listing side). Fees scale up as your home value rises. Market Exposure Full Exposure. Listed on the local MLS plus syndication to Zillow, Realtor.com, Redfin, and Trulia. Full Exposure. Listed on the local MLS plus syndication to Zillow, Realtor.com, Redfin, and Trulia. Contract Terms Flexible. Often month-to-month or until sold. You retain the right to sell on your own (FSBO) with no penalty. Restrictive. Usually requires a 6–12 month exclusive contract. You pay the commission even if you find the buyer yourself. Buyer Inquiries Direct Connection. Leads and calls are routed directly to you, allowing you to answer questions and vet buyers instantly. Filtered. The agent acts as a gatekeeper, filtering calls and scheduling showings based on their availability. Negotiation Style You Control the Deal. You negotiate price and terms directly, or hire hourly support only if needed. Agent Represented. The agent negotiates on your behalf, acting as a buffer between you and the buyer. Payment Structure Pay for What You Use. A la carte pricing means you don’t subsidize marketing costs for other clients. Bundled Service. You pay a high premium that covers the agent’s overhead, marketing for other homes, and office fees. Equity Retained Maximum. You save thousands of dollars at closing, protecting your hard-earned equity. Reduced. A significant portion of your equity is deducted at closing to cover listing fees. Flat Fee vs Commission: Definitions and Industry Overview The core difference between flat-fee and commission-based real estate models lies in their payment structures. Flat fee services charge a predetermined amount, usually between $100 and $1,000-for listing your property on the MLS, America’s largest database of homes for sale. You pay this fee upfront, often gaining direct control over pricing, showing schedules, negotiations, and more. By contrast, traditional commission-based services require you to pay a percentage of your home’s final sale price, typically split between the listing agent and the buyer’s agent. In 2026, the national average commission stands at 5.44%, but the listing side averages 2.77% and the buyer’s side 2.67%. This means that for a $500,000 sale, you could pay approximately $27,200 in commissions under the traditional model. Flat fee models are especially attractive to experienced or cost-conscious sellers, while commission-based agents often appeal to first-time sellers seeking comprehensive support. How Flat Fee Real Estate Works (with HomeRise examples) Flat fee real estate services offer sellers access to the MLS-a critical step for reaching 80% of buyers-without the burden of a high commission. HomeRise, for example, provides three distinct packages: Essentials ($95 plus a small settlement fee), Advanced ($495 plus settlement fee), and Full Service (1-2% success fee payable at closing). Sellers can choose the level of support they need, from simple MLS access to full local expert guidance. A real-world example: Chris Driver listed his Charlottesville, VA home with HomeRise and was under contract within 2 days, saving the full 3% listing fee. His advice: “Take really good quality pictures of your home and put together a warm, inviting, detailed home description. Go get a $20 lock box, and be cool with paying a fee for the buyer agent. You’ll save the entire listing fee of 3%.” Flexible service levels and transparent pricing are key advantages, allowing sellers with confidence and experience to maximize their profit while still having expert help on standby if needed. How Commission-Based Real Estate Works Commission-based real estate agents operate on a percentage of the sale price, paid only at closing. The standard split in 2026 is roughly 2.77% to the listing agent and 2.67% to the buyer’s agent. This approach bundles comprehensive marketing, professional photography, open houses, negotiations, contract management, and compliance with disclosure requirements. Agents conduct market analyses to price homes competitively and use their networks to attract qualified buyers. For first-time sellers or those in complex markets, this hands-off approach can reduce legal and logistical risk. According to current statistics, homes sold with agent support net $50,000 more on average than those sold

2026 Real Estate Review: Is Your Home Equity Working for You?

As we welcome in a new year, we tend to focus on self-improvement—cleaner diets, organized finances, and new fitness routines. However, homeowners often neglect the single most valuable item in their portfolio: their home equity. Following the market adjustments of 2025, many property owners are sitting on a surprising amount of accumulated value. Yet, that capital remains dormant until you actively measure it, secure it, and build a strategy around it. It’s time to move past assumptions and gain a clear picture of how your home is contributing to your overall net worth. What is a Wealth Checkup? A wealth is far more accurate than a quick search on an aggregator site. It is a strategic evaluation of what your home could command in today’s specific market conditions, balanced against your current mortgage liability. Why is this vital right now? 2025 was a year of market resilience and steady gains in many areas. Whether you invested in renovations or simply let the market appreciation take its course, your financial standing has shifted over the last 12 months. Clarifying your new “bottom line” is the first step toward smart decision-making in 2026, providing guidance for: Right-sizing: Moving to a home that better fits your current lifestyle. Cashing Out: Selling to unlock liquid assets for other investments. Reinvesting: Using a home equity line (HELOC) to fund major repairs or consolidate debt. Peace of Mind: Simply knowing your financial foundation is secure. The “Cost of Extraction”: Protecting Your Profit Calculating your home’s value is only half the battle; you also need to know what it costs to access that money. In the old-school real estate model, hefty commission fees act as a major drain on your appreciation. It is painful to see years of built-up equity evaporate into agent fees at the closing table. At HomeRise, we challenge that outdated norm. By leveraging modern efficiency, we help you get your property noticed and sold while ensuring you retain the lion’s share of your profit. Your equity is for your future, not inflated and unnecessary fees. 3 Steps To Your 2026 Valuation Study the “Sold” Column: Active listings only tell you what neighbors hope to get. To understand reality, you must look at closed sales in your zip code from late 2025. This concrete data is your true benchmark. Audit Your Improvements: Did you finish your basement? Update the electrical panel? Install energy-efficient windows? Certain functional improvements often carry significant weight in an appraisal, distinct from cosmetic changes. Partner with a Local Expert: Automated value generators cannot walk through your front door. They miss the nuances—like natural light, curb appeal, and layout flow—that a human expert sees immediately. Make 2026 Your Year of Clarity Don’t let your 2025 market gains remain a mystery. Whether you plan to list your property this season or stay put for the long haul, understanding your equity gives you financial leverage. Start the year with a plan. Review your assets, safeguard your investment, and enter 2026 with confidence. If you’re looking to sell this year, you can start building your listing yourself or look into further guidance with our pre-negotiated, full-service, low-commission agent network. Explore HomeRise’s full-service offering

FSBO vs Flat Fee MLS Listing: What’s the Difference?

FSBO vs Flat Fee MLS If you’re considering listing your home For Sale By Owner (FSBO), you recognize the potential for significant savings on real estate commissions and you’re preparing to take control. However, navigating the FSBO vs Flat Fee MLS landscape can be confusing. You may be wondering what costs and services are associated with a Flat Fee Realtor versus a pure Flat Fee MLS Listing. Are they the same? Which one will effectively provide the critical exposure your home needs? Understanding the nuances of the FSBO vs Flat Fee MLS decision is essential. Making the wrong choice could impact your selling experience, the level of control you retain, and ultimately your potential savings. Read on to clarify these options so you can win the FSBO vs Flat Fee MLS debate and choose the best route for your home-selling journey. What is a Flat Fee MLS Listing? At its simplest, a Flat Fee MLS Listing has you pay a single, flat fee to have your property listed on your local Multiple Listing Service (MLS). The MLS is the primary tool used by real estate agents to locate properties for buyers, significantly boosting your home’s visibility. When analyzing FSBO vs Flat Fee MLS, the primary advantage of the MLS option is cost-effective access to buyers without paying a full realtor commission. Your property gains exposure to a broad network of agents, far beyond what a “For Sale” sign or a basic FSBO website can achieve. However, this service typically caters to hands-on sellers. While the service provider handles the MLS listing, you’ll manage nearly everything else, including: Pricing your home accurately Handling inquiries and scheduling showings Negotiating offers directly Managing paperwork and closing details This option suits sellers confident in managing their sale independently. It is often the deciding factor in the FSBO vs Flat Fee MLS choice for those who want essential market visibility while maintaining full control and maximizing savings. What is a Flat Fee Realtor? The term “Flat Fee Realtor” is slightly more complex. Unlike a simple Flat Fee MLS listing, a Flat Fee Realtor involves hiring a licensed agent or brokerage that charges a flat fee rather than a percentage-based commission. This brings a new layer to the FSBO vs Flat Fee MLS comparison. The critical distinction lies in the scope of services provided. Some may offer services comparable to traditional agents, while others might only provide basic guidance alongside your MLS listing. Typical services from a Flat Fee Realtor may include: MLS listing entry Professional pricing advice Negotiation support Assistance with closing paperwork Given this variability, it’s crucial to clearly understand exactly what’s included. In the context of FSBO vs Flat Fee MLS, a Flat Fee Realtor bridges the gap between going it alone and hiring a full-service agent. FSBO vs Flat Fee MLS: Key Differences at a Glance Here’s a quick comparison to help you weigh your options in the FSBO vs Flat Fee MLS market: Feature Flat Fee MLS Flat Fee Realtor Service Level MLS access only; requires complete seller involvement. MLS access + varying levels of professional assistance. Control Maximum seller control. Professional guidance reduces workload but reduces control. Cost Most affordable ($). Higher flat fee ($$), but cheaper than commission. Ideal Seller Confident, hands-on FSBOs. Sellers wanting support while saving money. Pros & Cons of Flat Fee MLS for FSBOs Pros: Cost-effective exposure: The most affordable way to get on the MLS. Complete control: You manage the process, showing schedule, and strategy. Maximum savings: Retain the most equity possible, a key win in the FSBO vs Flat Fee MLS evaluation. Cons: Hands-on involvement: Requires time and effort to manage. Learning curve: Can feel overwhelming without real estate experience. No representation: You handle your own negotiations and legal paperwork. Pros & Cons of Flat Fee Realtors for FSBOs Pros: Professional guidance: Expert advice is available when you need it. Reduced workload: An agent handles some of the heavy lifting. Comfort level: Easier to deal with buyer agents when you have representation. Cons: Higher Cost: Typically more expensive than a simple MLS-only listing. Less control: You may have to defer to the agent’s strategy. Variable service: “Flat fee” can mean different things to different brokerages. How to Choose the Best Option for Your FSBO Needs Choosing your path in the FSBO vs Flat Fee MLS landscape depends on your comfort level, experience, available time, and desired assistance. Ask yourself: Are you comfortable handling contracts and legal paperwork? Are you confident negotiating directly with buyers and agents? Do you have sufficient time to manage inquiries and showings? Is your primary goal minimizing selling costs or balancing savings with professional assistance? If your answers indicate comfort, ample time, and minimal need for assistance, a standard Flat Fee MLS Listing might be ideal. If you prefer some guidance or feel less confident, consider a Flat Fee Realtor—but ensure clarity regarding included services. Why HomeRise Is Your Answer to “FSBO vs Flat Fee MLS” HomeRise’s Flat Fee MLS service specifically addresses FSBO sellers who want maximum savings, transparency, and essential market visibility. We simplify the FSBO vs Flat Fee MLS choice by offering: Clear, upfront flat-fee pricing Essential MLS exposure to thousands of agents and potential buyers Complete control over your sale process HomeRise simplifies your path to visibility without hidden fees, helping you confidently manage your sale. Want More Assistance? Consider Our 1% Listing Fee Partnership Recognizing that some FSBO sellers desire more comprehensive support without traditional high commissions, HomeRise also offers a unique 1% listing fee partnership: Substantial savings compared to traditional commissions Comprehensive services from a vetted, full-service professional agent Clear, predictable scope of services This option blends professional assistance with meaningful savings, providing clarity and reliability often missing from typical Flat Fee Realtor services. Conclusion: Choose Your Path to Success A successful sale hinges on making informed decisions tailored to your comfort and goals. Whether you choose the independent control of a basic listing or prefer additional professional support, understanding the FSBO

September’s Rate Drop: What FSBO Sellers and Buyers Need to Know

The Changing Market Landscape This Fall – HomeRise The Changing Market Landscape This Fall The real estate market could be in for a shake-up this September. Economists, analysts, and even prediction markets are signaling that the Federal Reserve will likely lower interest rates—something we haven’t seen in a while. While it’s only a possibility, a cut could ripple through mortgage rates, buyer demand, and home sale timelines. For FSBO (For Sale By Owner) sellers, this matters because demand is your fuel. If financing becomes cheaper, more buyers may be out searching—and with the right exposure through a flat fee MLS listing, you can tap into that energy without paying traditional commissions. For buyers, a more affordable rate could mean stretching your budget further, especially when paired with HomeRise’s cost-effective, tech-forward agent services. How Federal Rate Decisions Affect Real Estate The Federal Reserve doesn’t set mortgage rates directly, but it influences them through the federal funds rate. When that rate drops, borrowing across the economy often becomes cheaper, and mortgage lenders may follow suit. Historically, even a small decrease in rates has made a difference in how quickly homes sell and how much buyers can afford. That’s why sellers and buyers who are ready—or almost ready—should pay attention to the September meeting. Why September Is on Everyone’s Radar Financial heavyweights like J.P. Morgan and Goldman Sachs have updated their forecasts, now expecting the Fed to start cutting rates as early as September. Many believe a quarter-point cut could be the first in a series aimed at stimulating the economy. Market Intelligence Market pricing supports this view. Platforms like the Polymarket Fed Rates dashboard are showing strong probabilities that a September cut will happen. These numbers shift with new economic data, but the current odds are high enough to warrant attention from anyone making real estate decisions in the coming months. For FSBO Sellers Timing and exposure are key. A rate cut can bring more buyers into play, which means more eyes on your listing and potentially faster offers. For Buyers Lower rates mean more buying power. Even a small rate drop can save you thousands over the life of your loan. For FSBO Sellers: Timing and Exposure Are Key If you’re selling your home without an agent, the market’s momentum is especially important. A rate cut can bring more buyers into play, which means more eyes on your listing and potentially faster offers. By listing on the MLS with HomeRise’s flat fee service, your property appears alongside agent-listed homes in the same search results buyers are using—without the 5–6% commission. Even if rates don’t change, positioning your property on the MLS now means you’re visible when the fall market picks up. If a cut happens, you’ll already be in front of motivated buyers instead of rushing to list later. For Buyers: Affordable Financing Meets Modern Representation If rates drop, monthly payments on the same loan amount shrink, giving you more room in your budget. On a $350,000 mortgage, a 0.25% rate drop can save you $35–45 a month—or over $12,000 across 30 years. That’s real money you could put toward renovations, furnishings, or simply keeping your monthly expenses lower. HomeRise offers a modern, streamlined way to buy—combining the personalized guidance of an experienced agent with tech-enabled tools that make the process faster and more transparent. Best of all, our cost-effective commission model means you keep more of your money for what matters most to you. Should You Act Now or Wait? For sellers, waiting could mean hitting the market just as more buyers arrive, but it also risks missing the early movers who want to lock in before competition rises. For buyers, holding off could bring lower rates—but also more bidding wars. The smartest move is to get your ducks in a row now. Sellers can prepare their MLS listing, professional photos, and property details ahead of time. Buyers can get pre-approved, set search alerts, and be ready to move quickly if the right home appears. How HomeRise Puts You in Control HomeRise is built for people who want results without the outdated costs. For FSBO sellers, our flat fee MLS listings get you maximum exposure for a fraction of the price. For buyers, our modern representation model gives you expert guidance and the potential for rebates. When market conditions change—as they could in September—the people who save the most are the ones who combine smart timing with a smarter business model. That’s exactly what we offer. Get Started with HomeRise The Takeaway The September Fed meeting could be the start of a new chapter in the housing market. A rate cut may boost buyer activity and reshape affordability in ways that matter to both sellers and buyers. For FSBO sellers, this is the moment to ensure your home is on the MLS and ready to attract serious offers. For buyers, it’s a chance to lock in lower costs with the support of a cost-effective, modern agent. Keep an eye on the Polymarket Fed Rates dashboard for real-time updates, and start positioning yourself now. With HomeRise, you’ll be ready to act—and ready to save—whichever way the market turns.

8 Documents to Keep After Selling a Home

8 Documents to Keep After Selling a Home – HomeRise When you sell a home, keeping specific documents is essential for tax purposes, legal protection, and future reference. Here’s your complete guide to the key documents you should retain. 8 Key Documents You Should Retain: Closing Disclosure Statement: A detailed breakdown of all financial aspects of the sale, crucial for taxes and potential disputes. Deed of Sale: Confirms the transfer of ownership and protects against future disputes or fraud. Final Mortgage Payoff Statement: Proof that your mortgage is fully paid off, including any accrued interest and fees. Seller’s Disclosure Form: Outlines the property’s condition at the time of sale, ensuring transparency and legal compliance. IRS Form 1099-S: Reports the sale’s proceeds to the IRS, required for tax filing even if no taxes are owed. Property Tax Records: Proof of taxes paid, essential for audits or disputes with local authorities. HOA Documents (if applicable): Includes meeting minutes, fee payment records, and resale packages for compliance and dispute resolution. Home Warranty and Service Records: Covers warranties and maintenance history, useful for the new owner and potential claims. Quick Tips for Storage: Physical copies: Use a fireproof safe for originals. Digital backups: Scan and store securely in the cloud with encryption. How Long To Keep Documents After Selling A House? 1. Closing Disclosure Statement The Closing Disclosure Statement is like the financial roadmap of your home sale. This document meticulously outlines every dollar involved in the transaction, serving as your official receipt [3]. It lays out the final terms of your mortgage agreement, including the loan amount, interest rate, and monthly payment details [5]. It also breaks down all the charges negotiated during the process, such as fees, taxes, and escrow payments [4]. This detailed summary not only clarifies what you ow

How to Write Property Descriptions for SEO

How to Write Property Descriptions for SEO How to Write Property Descriptions for SEO Want your property listings to stand out online? Start with SEO. Optimizing property descriptions ensures they rank higher in search results, attract more qualified buyers, and drive better results. Here’s what you need to know: SEO is essential: Over 90% of buyers begin their home search on search engines, and organic traffic converts 25% better than paid ads. Keywords matter: Use terms like “3-bedroom home in Denver” to match what buyers are searching for. Long-tail keywords work best for targeting specific audiences. Local focus: Include location-specific terms (e.g., neighborhoods, landmarks) for better visibility in local searches. Mobile-friendly content: With over 60% of searches happening on mobile, keep descriptions concise and easy to read. Schema markup boosts visibility: Adding structured data ensures your listings appear as rich snippets, increasing clicks. Quick tip: Start descriptions with an engaging headline, highlight key features, and end with a clear call to action. Use U.S. formats for measurements and pricing to connect with American buyers. Ready to optimize your listings? Dive in for actionable tips. SEO Basics for Real Estate Listings What Is SEO and Why It Matters Search Engine Optimization (SEO) is all about making your online content more visible to people searching for it through organic search results [1]. Think of it as fine-tuning your property listings so they pop up when someone searches for terms like “3-bedroom home for sale in Denver” or “condos under $400,000 near downtown.” What makes SEO so powerful is its ability to connect you with buyers at the perfect moment – when they’re already looking for homes [2]. Unlike traditional ads that interrupt someone’s day, SEO works by meeting buyers where they are, right when they’re ready to make decisions. Google’s dominance in the search world makes this even more crucial. With 88.83% of the U.S. search market share [1], Google is where nearly nine out of ten searches happen. Optimizing for search engines essentially means optimizing for Google’s algorithm and how buyers naturally search for properties. Another reason to focus on SEO? Credibility. When your listings consistently show up at the top of search results, buyers start to see you as a trusted professional [2]. Organic visibility often feels more genuine than paid ads, which many users skip altogether. The numbers back this up. SEO leads convert at an impressive 14.6%, compared to just 1.7% for outbound leads [7]. Why? Because SEO captures buyers at the exact moment they’re ready to act – when they’re actively researching and comparing properties. Writing for U.S. Buyers Now that you understand the importance of SEO, it’s time to tailor your content to connect with U.S. buyers. Knowing your audience is key – they expect information to be straightforward, formatted in familiar ways, and aligned with their search habits. For example, using U.S. formatting like “$300,000” and “2,400 sq ft” signals to both buyers and search engines that your listings are relevant to the American market. Writing “2,400 sq ft” instead of “223 square meters” ensures your content speaks the language buyers are actually using in their searches. Another important consideration is the mobile-first nature of today’s market. Over 60% of real estate searches happen on mobile devices [4], and nearly half of all Google searches focus on local information [3]. Buyers scrolling through listings on their phones need clear, concise details without having to make mental conversions or guess what measurements mean. Beyond formatting, using location-specific language helps you stand out. Phrases like “modern villas for sale in Miami” [3] not only make it clear where your property is but also help search engines match your listing with the right audience. The effectiveness of localized strategies is clear. For example, in 2024, a campaign by Jennings Social Media & MarTech (JSMM) for the Miami Beach Visitor Center led to a 115% increase in qualified leads [5]. This success was driven by hyper-targeted content and performance-focused efforts. Finding and Using the Right Keywords Every successful property listing begins with understanding what potential buyers are searching for. Since most homebuyers start their journey online, knowing the exact phrases they type into Google is key to getting noticed. Put yourself in your ideal buyer’s shoes. Are you targeting first-time homebuyers looking for starter homes? Or maybe luxury buyers searching for high-end properties? Perhaps you’re appealing to investors seeking rental opportunities? Your keyword strategy needs to match the specific search habits of your audience. How to Research Keywords Keyword research tools can help you uncover what buyers are searching for and how competitive those terms are. Google Keyword Planner is a great starting point, offering data directly from Google Ads, including search volume and competition insights [6]. Popular Keyword Research Tools: Google Keyword Planner (Free): Great for basic research. Ubersuggest (Free): User-friendly for beginners and small teams. SEMrush (Paid): Ideal for SEO professionals looking for advanced insights. Ahrefs (Paid): Excellent for deep SEO audits and link analysis. Answer the Public (Free): Perfect for finding question-based keywords. For beginners, Ubersuggest is a solid choice, while advanced users might prefer the detailed analytics provided by SEMrush or Ahrefs. Focus on longer keywords rather than broad, generic terms. These specific phrases, like “affordable homes in Austin”, may have lower search volumes but often lead to better conversion rates compared to general terms like “Austin homes.” Kelly Sanchez, Content Marketing Manager at Sierra Interactive, emphasizes: “Optimizing for real estate keywords is a powerful way to increase your visibility, drive qualified traffic and grow your business” [6][7]. To refine your research, check Google’s “People Also Ask” section. This feature reveals common questions buyers have, helping you understand their concerns and tailor your content to address them [8]. Adding Local Keywords Local keywords are essential for real estate SEO since most buyers include location terms in their searches. Start by weaving city names, neighborhoods, and metro areas naturally into your titles and descriptions [7]. You can take it a step further by including school